As I write this article in January 2022, Sri Lanka has its back to the wall. There is a raging foreign exchange (forex) crisis with low levels of forex reserves held by the central bank, a significant monthly trade deficit with the external world, large foreign debt repayments due to be paid this year and for years to come, and no obvious way out of this crisis. The public debate hovers around whether the country should go to the IMF and restructure the debt, or perhaps borrow more from China and other Asian countries, or even default on the debt. None of these is attractive, but more importantly, none of these options will by themselves fix the long-term problem that Sri Lanka has. Any kind of new debt, or a debt restructuring will simply give Sri Lanka a short-term respite, but the forex monster will soon be back asking for more. This article takes a longer-term view, as we need to know what the solution to Sri Lanka’s problem is, before we look at what short-term tactical steps are available in the coming months.

Introduction

My hope in writing this article is to stimulate a broad discussion in the Sri Lankan establishment – and by that I mean government, business, the media as well as all those individual Sri Lankans with an interest in the subject – and move the conversation away from what I currently see as a very narrow party-political debate of whether to restructure or default and who is to blame for the current mess. That conversation will not get us much beyond political point scoring.

I have organised the article in sections as it is fairly long. I have numbered the sections so that it is easier to refer to them and debate them. I hope this will help the discussion.

- What is debt?

Most people do not know what debt actually is. A common misconception is that banks take deposits from customers and then lend it out as loans. Well let me surprise you – that is wrong. When you take out a loan from a commercial bank, the bank creates money out of thin air and lends that money to you as debt. You might then buy a house with that money, which then passes to the seller of your home, and that seller might deposit that money in her own bank account – which then creates a deposit. So, loans create deposits, and not the other way around. Most people reading this article are bound to be surprised by that. If you do not believe me, read this.

I started with that surprise because I want you to rethink your assumptions about debt and money.

So, for example, do you know what happens when you repay the loan back to the bank? That money is destroyed! Yes, it is destroyed. So, the stuff we call money that we use every day to buy things and do transactions, is an aggregation of our total debt. In fact, if there was no debt, there’d be no money. (A small amount of money though is created by the central bank of each country, also out of thin air, known as M0 money).

Let us put it this way then; if commercial banks did not create money in this way through lending, there would not be enough money to run the economy. Most money in the economy is created by commercial banks with a simple press of a button on a computer when someone borrows from that bank. If everybody repaid their debts on the same day, the economy would in fact run out of money, and it would not be possible to do day-to-day transactions. Weird but true.

- What is money?

Is debt the only kind of money there is? Well not quite. In all countries notes and coins are created by the central bank. Although definitions vary by country, central bank money is what is usually known as M0, MB or “narrow money”. Money created by commercial banks fall into categories M1, M2 and M3, or “broad money”. The amount of money in the economy varies by country but is related to the GDP of that country. See this world bank chart below:

As you can see the amount of “broad money” in the Sri Lanka economy is around 60% of GDP and is low compared with the US, UK and China.

There are several important things that I want to point out here. The amount of money in the economy is not fixed. It increases with GDP but also varies by country. As economies grow, more money is needed for transactions and for savings. Somebody has to create that new money – and that is usually done by commercial banks. The amount of money created by central bank’s is usually small compared with the total – but that has not been true in the recent past. The US federal reserve, for instance, has been printing (creating) vast quantities of cash under its Quantitative Easing program – also known as QE. So has much of the rest of the West – Japan, the EU, the UK. And so has the Sri Lankan central bank.

- Doesn’t printing money create inflation?

It is incorrect to say that printing money directly causes inflation. Some Sri Lankan media is focussed on money printing by the central bank as the root cause of Sri Lanka’s troubles. Keep in mind that commercial banks are always printing money each time they lend. They also destroy money when debt is repaid. But in general, the amount of money in growing economies always increases. The relationship between the quantity of money and inflation is not well understood and no economist has successfully predicted future inflation. All they can do is to say whether a certain action might help or hinder inflation. The actual outcome is as hard to predict as the stock market index or the weather. Why is that? The reason is that the final outcome of inflation at any given time is the aggregate result of the actions of the whole of the population. If for example when money is printed, people or banks simply save that money, inflation may not increase. Look at what happened to Japan. The central bank of Japan printed new money like there was no tomorrow for two decades and still failed to get inflation going!

However, the best way to know whether there is too much money in the economy is after the fact – ie by measuring actual inflation. That is why some central banks have a policy of targeting inflation itself. If inflation is rising too fast, central banks increase interest rates, and that reduces the amount of loans people are willing to take out, and that in turn dampens inflation.

So is Sri Lanka creating too much money at the moment on the 22nd January 2022? The answer must be yes – inflation is high, and the central bank increased interest rates a few days ago.

But this is not Sri Lanka’s primary problem.

- Does Sri Lanka have too much debt?

The primary problem Sri Lanka has is that everyone seems to agree the country has too much debt. Is that correct? The answer is not a simple yes or no.

The first thing to note is that there is internal debt denominated in Sr Lanka rupees (LKR) that is owed by the government, businesses and consumers to the Sri Lankan banking system. Is there too much debt there? – probably yes as domestic inflation is high and that indicates too much LKR-denominated debt.

But as we all know the real crisis is Sri Lanka’s external debt. The government has a total external debt of about $50b USD which needs to be repaid over a period of time. About $6b of that has to be repaid in 2022.

Now we talked about how banks print money – so why do we not simply print that money? Well, the US banking system can print as many USD as they like – but our institutions cannot. We can only print LKR. The irony here is that when we borrow dollars, US institutions simply print that money and lend it to us. But we have to pay it back in USD we earn. Why do we have to pay it back? Because that is the deal when you borrow. You have to pay back the capital that you borrow plus the interest – unless you are the government controlling that currency. So here is an interesting thing to notice. If you are an ordinary person and you borrow money from your bank, you know of course that you must pay that money back with interest. Globally anyone that wished to borrow USD is in the same situation as an ordinary citizen of a country – you must pay back that loan. Similarly, if you borrow Euro, you must pay it back – unless you are the European banking system. And the mirror image of that is true for Sri Lanka too – if a foreign institution (including the US government) wishes to borrow LKR – they have to pay it back to us! Unfortunately for us, nobody outside Sri Lanka is queuing up to borrow LKR.

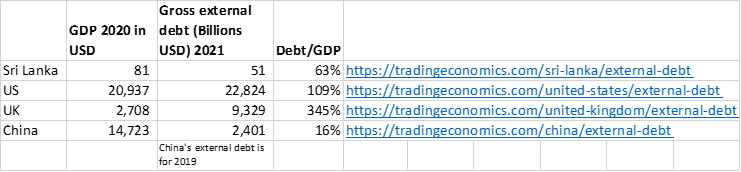

Back then to my question at the beginning of this section. Does Sri Lanka have too much debt – especially external debt? I am going to delay answering that question, for a little longer, but consider this statistic. The following table is the external debt of four countries. Look very closely please as the numbers might surprise you:

Are you surprised? Notice the UK has 5-times as much debt as Sri Lanka has as a proportion of its GDP. This, by the way, is the external debt of each country. That means the debt is owed to those outside the country. In the Sri Lanka case you can be pretty sure that debt is not denominated in LKR. In the US case it is very likely to be in USD. In the UK case it is not clear, but some of that external debt will be in GBP, while the rest will be in a mixture of currencies including EUR and USD. How then can the UK possibly have an external debt that is 3.5 times bigger than its economy? I will leave you to ponder that for a bit – and will come back to it soon.

Well now is our external debt too high? Firstly, I want to give you one more way of looking at our debt, in the next section.

- Sri Lanka has $51b of external debt. Is Sri Lanka already bankrupt?

Sri Lanka is not bankrupt. Let me explain.

One way of assessing whether Sri Lanka is bankrupt is to ask whether the country can pay its debt as it arises. Yes we know that Sri Lanka has trouble repaying its USD and other foreign-denominated debt “as it arises”. This test of paying debt “as it arises” is an important accounting test for insolvency and potential bankruptcy. On that test, we do not look too good.

Let’s ask a different question – can Sri Lanka pay its LKR debt as it arises? Absolutely yes. No country can ever actually be bankrupt in its own currency as governments have the sovereign right to print as much money as they wish and also have the sovereign right to tax its population as much as they can. So, it is impossible for Sri Lanka, or for that matter any other sovereign country, to be bankrupt in its own currency. Now printing lots of money is not a good idea – we know that may create inflation. But we also know from earlier in this article that money printing is not guaranteed to create inflation (if it was so, Japan would not be in permanent deflation).

So now, on the basis of those two tests so far, we have a -1 and +1 judgement. Yes, Sri Lanka is close to insolvency in forex terms, but certainly not when it comes to LKR and can never be. But there is another even more important test. And that is to look at Sri Lanka’s “balance sheet”. It is standard practice for accountants to look at the balance sheet of a company as well as its profit and loss statement when judging the health of that company. Funnily enough global economists never learned that lesson. No economist ever talks about the balance sheet of a country – they must have missed that class at Uni. Economists are always on about GDP and they measure everything as a proportion of GDP. That would be like judging a company by its revenue alone – ignoring the balance sheet and ignoring market value of that company. That is like looking at countries in 2D with one eye shut!

So let me add the third dimension to the view of Sri Lanka’s economy. Credit Suisse and McKinsey Global Institute publish a global wealth report for countries each year. You can find a quick summary of the Credit Suisse numbers for countries on Wikipedia here. Sri Lanka’s net wealth as a country is $351b USD. Yes, that is the net wealth after the $50b of external debt is deducted. So, our gross wealth is $400b if you add back the debt, which creates a balance sheet for Sri Lanka of $400b of assets and $50b of debt. Now I am sure most of you reading this article did not know that. Have you ever seen a newspaper quote that figure? Have you ever heard an economist quote that figure?

As you can see, Sri Lanka is far from bankrupt on that measure. An organisation that has $400b of assets and $50b of debt is not bankrupt. Sri Lanka is in fact quite a wealthy country by that measure and is #58 in the world league of countries by wealth.

This view also answers the question about the United Kingdom’s external debt. Did you notice from the previous section how the UK has an external debt of 345% of GDP totalling $9.3 trillion? Surely, they must be bankrupt right? But not so because you need to check out their net wealth. The UK’s net wealth according to Credit Suisse is $15T which means its net assets are $24T once you add back the debt. That is why the UK is not bankrupt – they have $24T of assets and $9T of debt. Any accountant knows that that is more than good enough.

So, let’s then focus on the obvious next question. If Sri Lanka has so little debt compared with the UK, and our “country balance sheet” is so healthy, why do we get so much grief from the financial markets? Let’s look closely at the numbers again for the UK compared with Sri Lanka:

Sri Lanka’s debt to assets ratio is 13% compared with the UK at 62%. How is it that the UK is not in even hotter water than us? The answer is that much of the UK’s debt is seen by the markets as “secured debt” while our SL debt is primarily seen as “unsecured debt”. Let me explain.

The UK as you all know has an open economy, it has a currency that is freely exchangeable, and a body of law (English law) and courts that are trusted by people around the world. (Full disclosure – I live in Edinburgh UK).

It means that when external parties in other countries lend to UK’s institutions that debt is secured on assets owned by the UK institution that is doing the borrowing. If the UK borrower is unable to repay the debt, the lender will seize that asset, sell it and recover the debt. This is the way loans work globally. Most importantly if there is a dispute between the borrower and the lender, the UK courts would resolve the matter and if necessary, the ruling could go all the way to the supreme court where a final ruling would be made. The important thing to know is that this process is totally independent of politics, democracy, and government. It does not matter what the people of the UK think about the matter, the courts will rule in favour of the foreign lender if that lender is deemed to be in the right – no more questions asked. Property rights in the UK are guaranteed by law and by the independence of the courts. Even more importantly all foreigners trust that system of law and the independence of the UK’s courts when it comes to matters of property.

I do not need to tell you that this is not true for Sri Lanka. The problem at heart is our perception of national sovereignty. We do not of course have a freely exchangeable currency (which means that LKR cannot be used to repay a foreign debt – unlike GBP can), and we do not have a system of property rights for foreigners, because we think Sri Lanka is for Sri Lankans. That at the end of the day is a political judgement for the Sri Lankan people and the Sri Lankan government. We seem to think that foreigners owning land in Sri Lanka is unacceptable (contrast that with the UK and US where large swathes of the country are owned by foreigners, including by Chinese and Russian investors whom the West do not like that much). Do we really value our national sovereignty so much more than the US does? And do we understand the downside of that choice we have made? Did we ask the people of Sri Lanka in an educated debate about the choice the establishment has made for them? Guess what – you cannot eat sovereignty. Sri Lanka really must rethink this in an open and clear manner.

Back then to the problem Sri Lanka has with its debts. As foreign lenders cannot be sure that we will not default on our debt (and all those people urging the government to default are making matters worse), Sri Lanka cannot borrow and secure that borrowing against our assets in the way that a country like the UK can. Please have no doubt that this is a mess of our own making. Sri Lanka can change the situation overnight by changing our laws to guarantee foreigner’s ownership of Sri Lankan assets, and by guaranteeing that foreign debt will always be serviced and repaid – by law.

- Sri Lanka is a bit like a Scottish castle and estate

Let me give you a little example to explain the strange problem Sri Lanka has that I described in the last section. When I first came to live in Scotland in 1979 as a young PhD student, one of the intriguing aspects of Scottish Life was the way large parts of Scotland were owned by landed aristocrats. These estates could even include mountains and rivers and often a castle too. This is a legacy of Scotland’s feudal past. Now the interesting thing was that quite often the estate did not actually manage to pay for itself. The castle was sometimes in a dilapidated condition because the estate’s revenue was not enough to pay for its upkeep. The family that owned the estate was not bankrupt of course but they refused to sell some or all of the land as it had been handed down over centuries. As you can imagine the ordinary citizens of Scotland didn’t really feel that sorry for these poor landowners.

That is what Sri Lanka looks like from the outside. We are a rich country with a huge value hidden inside. But we do not know how to deploy it. We are stuck with out of date thinking about sovereignty, and we have not yet understood how to fully open our economy and take part in the capitalist success enjoyed by the rest of the world.

Switching back quickly to those poor Scottish aristocrats, they learned over time how to get out of their predicament. They learned to open their castles to the public, make sure there was a nice tearoom that had expensive cakes and tea, sell off bits of the estate to fund improvements to the castle etc.

Think about what that means for Sri Lanka. We can easily get out of our debt hole tomorrow morning by (a) changing the law to secure foreigners’ debts and (b) by selling off some assets to repay those lenders that want their money back now.

- Should Sri Lanka default on its debt?

Absolutely not. Only sovereign countries can even contemplate defaulting on debt and getting away with it.

Let’s consider first what would happen in a normal debt scenario within a single country. If a UK borrower defaulted on his debt, the courts would ensure that his remaining assets are forcibly sold off to pay the debt and the borrower would be bankrupted. Once bankrupt that person would not be able to easily borrow again in the future. You get to be bankrupt only once! It is a pretty serious situation for any person to become bankrupt. If bankruptcy happens to a company, the directors of that company would be in a similar situation when it comes to any business they might attempt in the future.

Why is that different for a country? Well, a sovereign country could misuse its sovereignty to simply refuse to pay. There was a time when Western powers would send gunboats to sort out the situation, but these days lenders would simply cut-off that country, so it is not possible to borrow again in the future … for perhaps a very long time.

Be very clear that to refuse to pay our debt is simply a form of theft. We would essentially be stealing money from the lenders. That is why it is not a great idea, and that is why lenders will not forget what we did.

Now a legitimate question for you to ask me here is this: I thought you said when we borrow money lenders simply print the money and give it to us. So why is it such a big deal if we simply refuse to pay? A good question indeed. Yes, that is absolutely right that when you borrow money the bank creates money and lends it to you, and when you repay, the bank destroys that money. But here is the kicker … if you do not repay and default on your debt the bank has to destroy that loss out of its own money. So, all bad debt becomes a real loss to the bank. To not repay is to steal from the bank. That is why Sri Lanka must not do that.

- So the way forward is to sell assets? What about the IMF?

Selling Sri Lankan assets is indeed one way forward. In total there are three ways out of our debt hole. But none of those involve the IMF. Let us first talk about the IMF option. It is firstly important to note that the IMF is a misnomer. It is not an “international” institution in that the world’s population owns it equally or that the world’s countries control it equally. It is essentially a Western institution whose primary purpose is to protect the interests of Western lenders. That does not make them bad – but we need to know why they exist and who they ultimately answer to.

There is a lot of noise in western newspapers about the China debt trap. But be in no doubt that all debt is a form of trap. If you owe $1 to a bank and you are unable to repay that debt, the bank then controls you until you pay that debt (or your assets are dissolved to pay that debt and you are bankrupted). That has always been true and will always be true. In the battle of the debt traps be aware that our choice here is a Western debt trap or a China debt trap or an India debt trap. Debt is always a trap if you cannot repay it. Someone else dictates what happens to your assets at that point.

Let us talk a bit about China vs the West for a moment. Here is an interesting statistic that might surprise you. I mentioned the McKinsey study on national wealth earlier. China has now overtaken the US in terms of total national wealth according to the report. On a “purchasing power parity” (PPP) basis the report estimates total US wealth at $89 trillion in 2021 (that is the “net assets” position of the US as a whole), while it estimates China to be $201 trillion – which is more than double that of the US! Makes you think about where our borrowing should come from – but at the end of the day any debt that you cannot repay puts the country in a bad place and it doesn’t really matter whether it is China or the West that lends to us.

Back then to the IMF (or more accurately the WMF). The thing the IMF can do for us is to help us negotiate with our lenders and restructure our debt. If this results in a prolongation of the debt repayment timescale, well we can probably achieve that ourselves by talking to the lenders directly. We do not need the IMF for that. Be in no doubt that lenders’ real interest is to keep lending to us and continue to earn interest from that loan. That is how banks make money. The only reason they want us to repay now is because they are worried we may not be able to repay later. If the lender believes that we will absolutely repay, then guess what, they are no longer in a hurry to be repaid – more jam for them in interest paid.

So, debt restructuring is not where the IMF really helps. The IMF can help to make lenders take a “haircut”. What does that mean? A haircut has little to do with hairdressers but everything to do with making the lenders agree to lose some of the capital they lent us. Eg to agree that 20% of the debt need never be paid back and be written-off. This is of course a form of legitimised theft. The IMF gets the lenders to agree to us “stealing” 20% of the loan in return for us paying back the rest of the 80%. As you can imagine, that’s not a nice place for the lenders to be in, and they will remember that and be far less keen to lend to us in the future. But in return for this official theft by us, the IMF usually imposes draconian rules on what the government must do to the domestic economy.

This as you can see is a lose-lose situation – and of course it needs to look like a lose-lose for the lenders to agree. The lenders lose some of their capital, the government is forced to follow the IMF’s diktats which are mostly rubbish (if they knew how to run a country, they would not be working for the IMF), and Sri Lanka goes a little bit deeper into a Western debt trap while Western politicians feel empowered to walk all over us.

Talk of losing sovereignty!

Even more crazy when you consider that Sri Lanka has its very own “Scottish castle” worth $400b that we refuse to mortgage or sell. Crazy crazy.

The IMF is absolutely not the way forward for Sri Lanka for one final massive reason. It is essential to understand the root cause of our debt problem which is of course Sri Lanka’s huge forex leak. I will talk about this in much more detail in the rest of this article but suffice to say here that if Sri Lanka did not have a persistent trade deficit (and current account deficit) we would not be in this situation. The years 2020 and 2021 were of course particularly bad for Sri Lanka due to Covid.

So although the IMF can give us short term debt relief, it will not fix our trade deficit. Sri Lanka quite simply buys much more in forex than we sell in forex. That’s the root cause of our long-term external debt problem. Going to the IMF will not fix that. The IMF will simply put a sticking plaster on our arterial wound and send us home – and Sri Lanka will continue haemorrhaging forex. The IMF will fully expect us to be back again in 2 years’ time asking for yet more debt relief. That is a debt-trap.

- You said there are three ways forward that do not include the IMF. Were you serious?

Absolutely serious! We do not have to do them all – but they act over different timescales – so all three of these make sense. Here they are:

- Fix our laws to give foreigners absolute ownership rights over Sri Lankan assets

- Sell Sri Lankan assets

- Fix our trade deficit with an Industrial Policy

The first of these is the quickest (but politically most difficult) thing to do. If our external debt can be secured against Sri Lankan assets that are guaranteed by law (and by that I mean it needs to be absolutely water-tight with an absolute constitutional guarantee that cannot be tinkered with by a future government), the pressure to repay our debt vanishes overnight. Here’s why:

Lenders make money by lending. They are not in a hurry to get their debt repaid if (a) the borrower continues to pay interest and (b) there is no risk whatsoever that the borrower will default.

Think about the US for a moment with its $22 Trillion external debt. That is not just government debt but US institutional debt too. When will the US pay back all that debt? Actually never. There is no plan to repay any of that debt, but foreigners will continue to lend to the US. That is because if any of the US institutions default, the law provides recourse to the lenders to seize assets and recover the debt. That does not mean that individual debts are not being repaid. But as a total, US debt rises every year. Foreigners are happy to fund that because they can cash-in their loan anytime (e.g. by selling that loan to someone else) and they get interest payments while they hold US debt.

So here is the strange thing – not only do rich countries create more and more debt every year which they can never repay (and that debt circulates as “money” in the economy), if they ever tried to repay that debt the economies would simply have too little money and there would be massive deflation. It is crazy but true that economies need to create more and more debt to ensure there is enough money to run the economy. When Western banks did not create enough debt in the last few years (or in Japan’s case in the last 20 years), western central banks had to print money – famously known as Quantitative Easing to stop a deflationary spiral.

Even though Sri Lanka is nowhere near as rich as the West we could join the same benign pool of money creation if we (a) make the Sri Lanka Rupee fully convertible and (b) guarantee property rights independent of nationality.

If we did this tomorrow, our debt problem would be permanently and immediately banished. But just doing part (b) would solve our immediate issue. It would remove the urgency for lenders to be repaid. They would be happy to simply delay repayment while we pay interest, knowing that their capital is bullet proof and safe. They will also understand that Sri Lanka has entered a new era of fully joining the world economy, and that would mean the $400b of assets will appreciate a lot faster in future. A very virtuous circle to get into.

- Sell parts of Sri Lanka’s “Scottish castle”

As we discovered earlier, Sri Lanka as a country has a balance sheet with $400b of assets and $50b of external debt resulting in a net assets position of $350b.

As I said in the previous section the first easy way out of our debt dilemma is to simply change the legislation around the ownership of Sri Lankan Assets.

An alternative is to sell parts of our “Scottish Castle”. For example, sell prime beach property to a foreign hotel chain and give them freedom to develop it. Sri Lanka plans to sell property in Colombo Port City as far as I understand it. Totally right too, and we should be doing that asap. Economynext says that the initial land sales for just 20 plots of land are estimated at $5b.

Let’s take a few minutes to consider the Port City project. There is a lot of nonsense written about it being a China debt trap and a waste of money. Just a little moment please. The land reclamation project cost Sri Lanka $0.9b which created land worth $5b in phase 1 and a total sellable land value of $15b. All those people who have complained about this project – how many of you have invested $1 and got back $15 a few years later? This was a totally brilliant project in my opinion and only the government could have done this. Some people think that this type of idea should be left to private companies – well really? Could a company have simply created an island off the Sri Lankan shore with no government help?

In the longer term once the Port City is fully built the total amount of wealth created by it will probably exceed $100b (my estimate). And you know what, we could do it again one day in the future and have a second island, and then a third.

The beauty of Port City is also the ability to set the property laws to be investor friendly like I said in the section above. So, I accept that Sri Lanka may not want to free-up property laws across the whole of the country and make our Scottish Castle fully part of the world economy – fine. But please Sri Lanka, do get that right for Port City. We must make sure that ownership rights are absolutely guaranteed by law, independent of the nationality of the owner.

- Tackling Sri Lanka’s persistent trade deficit

Sri Lankans apparently like the good life. And so, they should! If we want to buy an iPhone or a Mercedes Benz and we can afford it, we should be able buy it just like the rest of the world. But here’s the rub – we also as a country need to sell things back to the rest of the world! Otherwise, we have a trade deficit and a negative current account balance which means a persistent forex problem. That is where Sri Lanka is today.

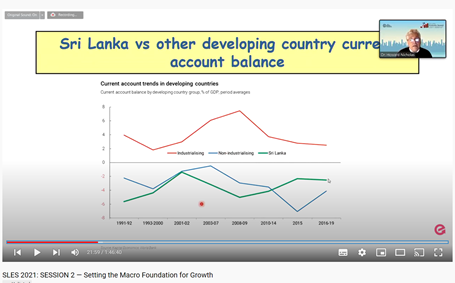

Take a quick look at the current account balance for Sri Lanka. The “current account” of a country covers all forex movements – not just the trade deficit, but it captures money remittances and all foreign exchange movements.

You can see the problem – we have a sea of red ink. Sri Lanka is constantly spending more forex than it earns, and so has to borrow forex to pay for imports. This obviously cannot keep going forever – the country will simply have bigger and bigger debts to pay.

You can see the problem – we have a sea of red ink. Sri Lanka is constantly spending more forex than it earns, and so has to borrow forex to pay for imports. This obviously cannot keep going forever – the country will simply have bigger and bigger debts to pay.

Now fixing the trade deficit is not easy and will take time. Unlike financial engineering with asset sales and property freedom that I outlined above, fixing the trade deficit takes a lot more effort and much more time to achieve. But once we do that, we are finally out of the foreign debt problem – and permanently so. The Sri Lankan establishment talks about self-sufficiency in turmeric or in rice. That is crazy. We need to be self-sufficient in forex. That’s all. Once we have done that, we can buy whatever we want – a Mercedes Benz, or maybe even as much turmeric as we want ..!

As the famous Scottish Economist Adam Smith wrote in his Wealth of Nations published in 1776, countries must focus on their competitive advantage.

We really must learn from Adam Smith, and from Singapore a country that is a perfect example of how to focus on competitive advantage. Guess what – Singapore does not need to worry about turmeric – they just buy what they want. Singapore has had a current account surplus of around 20% of GDP for nearly 30 years. See:

Once you have a permanent positive forex situation the country has true sovereignty. There is no need to worry about external debt. It does not mean you do not have debt – in fact Singapore has an external debt of 501% of GDP secured against its many assets ($3.3T gross).

So how do we become Singapore? Sri Lanka needs to start selling to the world what the world wants to buy. Tea, rubber and coconut alone will not do it.

- Creating an industrial policy for Sri Lanka

The only way to change the long-term forex problem that Sri Lanka has is to have a government led industrial policy. The US and the West have always argued the opposite. The conventional wisdom is that the private sector should be left to do the innovation while governments stay out of the commercial sector. The funny thing is the West did exactly the opposite when they were developing their economies. The West says to us – don’t do as we did, do as we tell you. Prof Ha-Joon Chang’s brilliant book “Kicking Away the Ladder” is essential reading for all those interested in the subject. Prof Chang‘s primary point is that the West is kicking away the ladder that they themselves used to get to the top of the global economy. Indeed, it works well for the West that countries like Sri Lanka do not have a competitive advantage, and that we continue to buy Western goods and sell our tea back to the West, and that we run to the IMF and ask for debt relief when we cannot buy enough food to feed ourselves. I am not saying here that the West and the IMF are malicious – just that all of their advice and their Institutions are looking after themselves – not us. That is fine as far as it goes – but we just need to be aware that that is what is happening. Let us not imagine that an IMF prescription for Sri Lanka is in Sri Lanka’s best interests. The IMF is simply doing what is best for Western institutions.

Sri Lankan, and eminent economist Prof Howard Nicholas of Erasmus University Rotterdam, has been arguing the case for Sri Lanka to have an industrial policy forever. But it seems nobody is following that advice. I was blown away by Dr Nicholas’s comparison (minutes 3-35 in the video) of countries with and without industrialisation. Developing countries that are industrialised are the red line below with a positive current account balance while countries that are not industrialised have a negative current account (in blue) and Sri Lanka is part of that same club (green).

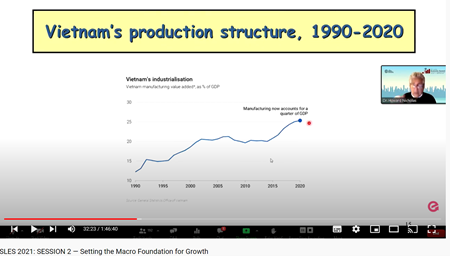

Prof Howard also pointed out Vietnam’s recent experience. Vietnam has turned itself into a manufacturing powerhouse as shown in the chart below…

Prof Howard also pointed out Vietnam’s recent experience. Vietnam has turned itself into a manufacturing powerhouse as shown in the chart below…

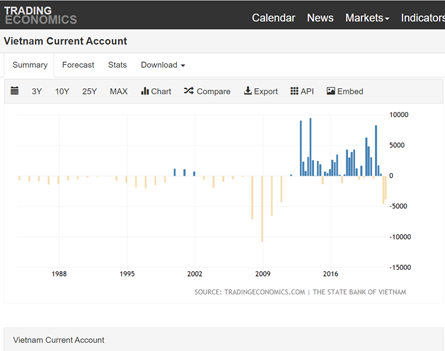

And look at what it did for Vietnam’s current account balance:

It is essential that Sri Lanka moves away from its chronic forex problem to a neutral or positive current account balance and thereby to independence from foreign debt problems. The only way to do that as Dr Nicholas shows is to industrialise.

- Competitive advantage and industrialisation

Achieving a national competitive advantage in a sector of industry does not necessarily mean that Sri Lanka needs to focus on inherent advantages. So for example sun and sea are a natural advantage that Sri Lanka has over some other countries. But that does not mean that we must create all our industries around it. Tea, rubber and coconut are another such advantage SL has – but again that does not mean we must build our industrialisation around that either. Singapore demonstrates that its competitiveness does not arise from an inherent natural advantage.

Let us examine two examples to demonstrate what I mean here. Denmark is a world power in pig farming and pork products. Checkout this excellent article in the Economist “Bringing home the bacon”. This is a perfect template for what Sri Lanka should be doing. As you see from the article the government orchestrated a cluster of companies to create a world class pork industry. This is something even more difficult in Denmark where wages are high (GDP per capita is $61,000 PPP). You might think that the competitive advantage in pork farming would surely go to the country with the lowest agricultural labour cost. Obviously not. A sophisticated IT driven innovative industry can take on anybody in the world.

There are several key points from this for Sri Lanka:

- The government must orchestrate and create the conditions for clusters of companies. (Never subsidise or directly aid individual companies. Allow each company to sink or swim. Do not prop-up failing companies. The death of a company is the rebirth of a better company).

- Drive technical innovation through government support for the cluster. Relentless productivity improvement is the key to global competitiveness.

- Ignore the Western religion that government should get out of the way – Western nations have succeeded by ignoring that very advice.

The second example is China’s Shenzhen. As most of you know, Shenzhen is the core of the world manufacturing industry. Shenzhen has a population of 23m – the same size as Sri Lanka, and has a GDP of $737b PPP which is a factor of 2.5 more than Sri Lanka. Some Westerners sneer that Shenzhen’s advantage comes from low labour costs. This is far from the truth. Shenzhen consists of a massive cluster of companies from small to medium to huge that specialise in every possible aspect of manufacturing. I have personally witnessed that for myself. As part of my business travel for my company KAL, I have travelled to China around 50 times and have been to Shenzhen numerous times. KAL has a manufacturing partner in Shenzhen. What is amazing about Shenzhen is how much expertise there is in every possible aspect of manufacturing. For example, my industry requires what are known as encrypting pin pads (EPPs) for installation in ATMs. These are highly sophisticated electronic components that require a very high standard of security and regulatory compliance. There are very few companies in the world that can build these devices – there is one in San Jose California, one in Denmark and two in Shenzhen. A device like that not only requires overall expertise to design the device itself but also a long supply chain for sub-assemblies and components. As you can imagine Shenzhen does it all (and I wouldn’t be surprised if some of the components required by the US and Danish companies also actually come from Shenzhen).

The point is this – this is competitive advantage that is not easy to replicate and is certainly not about low wages. It is also competitive advantage that is not built on some inherent natural advantage. It is an advantage created by a cluster of companies innovating and producing components and systems in a highly complex supply chain of parts with government encouragement where needed. Shenzhen, as you can imagine, is a cauldron of change and innovation. Companies are created and companies die. The government does not tell companies what to do. The government encourages and keeps a watchful eye. This is human capital in action.

- How should Sri Lanka industrialise? Which industries make sense?

In many ways we can just choose, in the same way that Denmark chose pig farming. The world has massive demand for products and services. World GDP is around $100T which also means that the world buys $100T of products and services every year! We are spoilt for choice.

Let us try an idea to get the conversation going. What about the car industry? Should Sri Lanka attempt to build cars for the global economy. Err no! The car industry is dominated by huge companies like Toyota – we cannot possibly compete with Toyota starting from a position of nothing. But the car industry has a massive supply chain. Toyota does not make every bit of a car by itself. There are thousands of components that need to be manufactured before the final car is built by Toyota. Those global supply chains are the key to Sri Lanka’s plans. We could pick a small piece of a chain – let us say the catalytic converter of the exhaust, and try to enter the world market for catalytic converters and splice ourselves into the supply chain. That’s not going to be easy though as there are existing manufacturers of catalytic convertors – so maybe catalytic convertors are not the best idea.

Obviously, it makes sense to ask what supply chains are already running through Sri Lanka and what industrial knowledge is already in Sri Lankan companies. The government should survey Sri Lanka’s industrial base and identify all companies that are already strong enough to be part of a global supply chain. The best place to start is where there is a cluster of existing companies focussed on specific links of a supply chain. Government support to those companies through R&D grants, innovation support and knowledge dissemination can help those companies to muscle-in on the supply chain and expand to adjacent links too. That is how Shenzhen did it.

- Advice to the government on industrial policy

- Identify areas that Sri Lanka can target.

- Never support or invest in a single company

- Always help a cluster of companies

- Create independent agencies to oversee each industrial sector

- Setup the agencies, write the rules, and then step back

- Give them independence like the Central Bank has independence. Ensure there is no political interference. Government must never interfere in operational matters of companies, or the cluster

- If the government is going to print money give it out as grants for innovation

- Never subsidise individual companies or protect individual companies from failure Better companies will arise from the death of a poor performer. If the company cannot compete in the world market it is all the better that it gives up its resources, especially the human resources, so others can do better

- In Conclusion

This then is a blueprint for how Sri Lanka can emerge from its current forex debt woes. I chose to publish this article on the 4th February because this is the way forward to true independence and sovereignty.

There are three things we need to do:

- Fix our laws to give foreigners watertight rights over Sri Lankan assets when those assets are used to secure debt

- Be willing to sell Sri Lankan assets when we have to

- Fix our long-term trade deficit with an Industrial Policy and do that using independent agencies to oversee clusters of local world-class companies

Good luck Sri Lanka and be the pearl of the Indian Ocean again. Your destiny is in your own hands.

Aravinda Korala, 4th February 2022